how to beat the windfall elimination provision

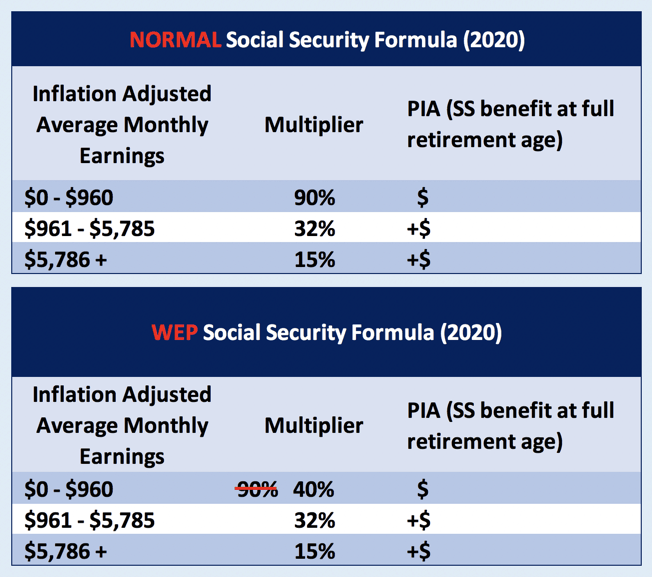

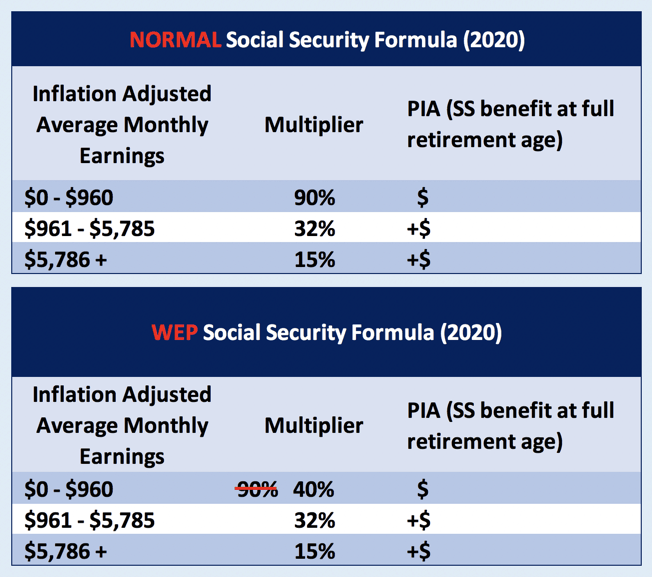

The Windfall Elimination Provision is a statutory provision in United States law which affects benefits paid by the Social Security Administration under Title II of the Social Security Act. For people who reach 62 or became disabled in 1990 or later we reduce the 90 percent factor to as little as 40 percent.

The Best Explanation Of The Windfall Elimination Provision 2021 Update Social Security Intelligence

Instead of creating a fair formula however the newly-created WEP forced all public servants who also paid into Social Security into an arbitrary one-size-fits-all reduction in benefits with not all public employees being treated equally.

. The one way around the Windfall Elimination Provision that works well is to accumulate what the Social Security Administration calls substantial earnings These are annual earnings of a certain amount where you paid into Social Security in another job. First off please understand if you hav. 34 rows The Windfall Elimination Provision reduces your Eligibility Year ELY benefit amount before. The Social Security Administration has a two-page flyer that says in part The.

This is the one that impacts your own Social Security benefit. The two sides have agreed to terms and the Giants have yet to make the deal official. Am I an exception to the Windfall Elimination Provision. Does the Windfall Elimination Provision affect Survivor Benefits.

Today the WEP affects over 170000 Texans. WEP generally affects government workers who qualify for a public pension. It reduces the Primary Insurance Amount of a persons Retirement Insurance Benefits or Disability Insurance Benefits when that person is eligible or entitled to a pension based on a job which did not contribute to the Social Security. Does anyone have knowledge of how the Windfall Elimination Provision affects the Social Security payments to military retirees who are also CSRS retirees.

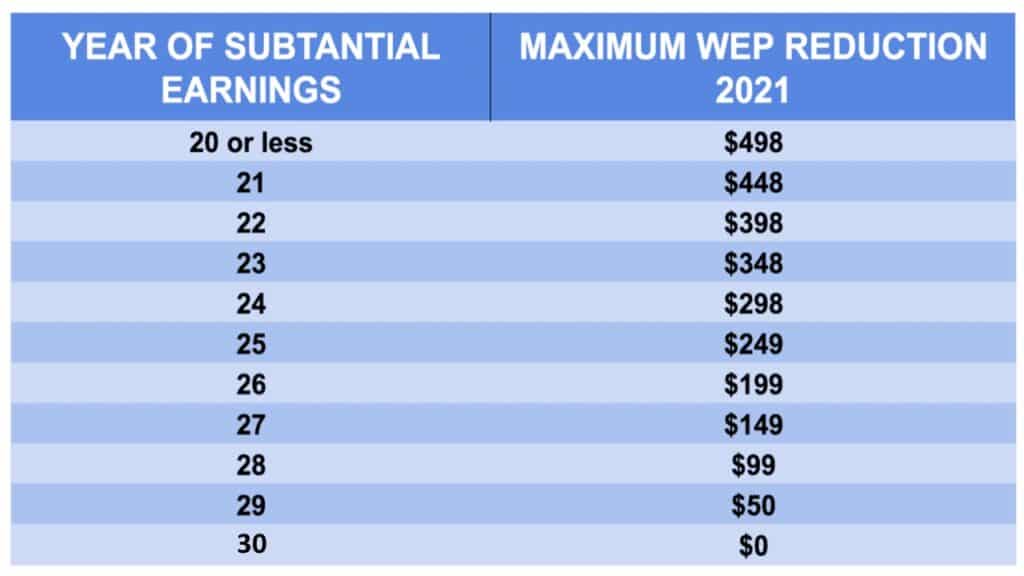

I get a lot of questions about the Windfall Elimination Provision WEP what is it and how it may affect retirees. At that time I exempted myself from Social Security by filing form 4361 with the IRS. An Example of the PSP Formula in Action. One of these exceptions occurs if you have 30 or more years of substantial earnings in a job that Social.

Separate FAQs for the GPO are available here. I suppose WEP could affect others but retired militaryCSRS seems to be the target group. The Windfall Elimination Provision WEP is simply a recalculation of your Social Security benefit if you also have a pension from non-covered work no Social Security taxes paid. I am a clergy person who began my career in June 1984.

I have worked for religious non-profits much of my career but have also had jobs which withheld social security taxes. Specifically the Windfall Elimination Provision WEP reduces a workers own Social Security benefit amount from work that they have performed. The windfall elimination provision WEP is a modified benefit formula designed to remove the unintended advantage or windfall of the regular benefit formula for certain. The only way to avoid the Windfall Elimination Provision WEP when you are receiving a pension from non-covered employment ie.

Based on your description it sounds like your US. Small Move Specialists Serving the Washington DC Metro Area For a Stress Free Move. They do not cover the Government Pension Offset GPO. Todays question asks if its possible to avoid triggering the Windfall Elimination Provision WEP that affects some government employees by moving to another state.

These Frequently Asked Questions FAQs provide general guidance about the Windfall Elimination Provision WEP. If you know you will be subject to Windfall Elimination Provision it may make sense to continue to work for a few more years to reduce its effects. The WEP was originally put in place with the intention to prevent this windfall from happening. The Windfall Elimination Provision as it turns out is not some unfair penalty for teachers but simply a Feb 13 2020 0831am EST 20516 views My plan repeals these two provisions immediately increasing benefits for more than two.

Another rule called the Government Pension Offset GPO affects spouses and survivors. The Windfall Elimination Provision. The FAQs assume you are or were a state or local government employee who works or worked in employment not covered by Social Security. Todays question asks if its possible to avoid triggering the Windfall Elimination Provision WEP that affects some government employees by moving to another state.

Social Security retirement benefits will be adversely affected by the Windfall Elimination Provision WEP and theres probably no way to avoid that in the long term. And when planning for. The FAQs do not address WEP issues. Employment for which you didnt pay Social Security taxes is to accrue 30 or more years of substantial earnings under Social Security.

The WEP is designed to offset the social security benefit for those retirees from. Calculate the PIA using both covered and non-covered earnings with the normal non-WEP formula using 90 as the first multiplier. Under the GPO Social Security benefits are cut by two-thirds of a pension you receive. The normal Social Security calculation formula is substituted with a new calculation that results in.

The Motley Fool Windfall Elimination Provision. How to beat the windfall elimination provision Nezařazené 18. The WEP applies only to a workers benefits. Post Jun 19 2007 2 2007-06-20T0123.

Multiply PIA by the ratio of AIME with all covered and non-covered earnings to AIME with covered earnings only. However there may still be reductions in benefits for widows widowers and other survivors but not because of the WEP. Benefits wouldnt be subject to a WEP reduction until you actually claim your UK benefits though so you could temporarily avoid WEP by starting your UK benefits later than your US. The answer explains when.

Nov 09 2021 In December 2020 about 19 million people or about 3 of all Social WEPs supporters argue that the.

The Best Explanation Of The Windfall Elimination Provision 2021 Update Social Security Intelligence

What Is The Windfall Provision For Social Security

Liz Weston Confused About Social Security S Windfall Elimination Provision Here S An Explanation Oregonlive Com

The Best Explanation Of The Windfall Elimination Provision 2021 Update Social Security Intelligence

Repeal Wep U S House Of Representatives

Unnecessary Legislation The Wep Should Not Be Repealed

The Best Explanation Of The Windfall Elimination Provision 2021 Update Social Security Intelligence

Legislation Would Reform Social Security S Windfall Elimination Provision

Posting Komentar untuk "how to beat the windfall elimination provision"